Analytics to Outcomes: Optimizing Outpatient RCM Performance

March 10, 2025I recently had the opportunity to present on an HFMA webinar with my colleagues, Brian Kemp, vice president of strategic revenue cycle operations and initiatives, and Stephanie Denham, vice president of RCM systems and analytics. This webinar covered the importance of data-driven decision-making and how hospitals and other healthcare organizations can optimize their revenue cycle management (RCM) by leveraging analytics to drive meaningful operational improvements.

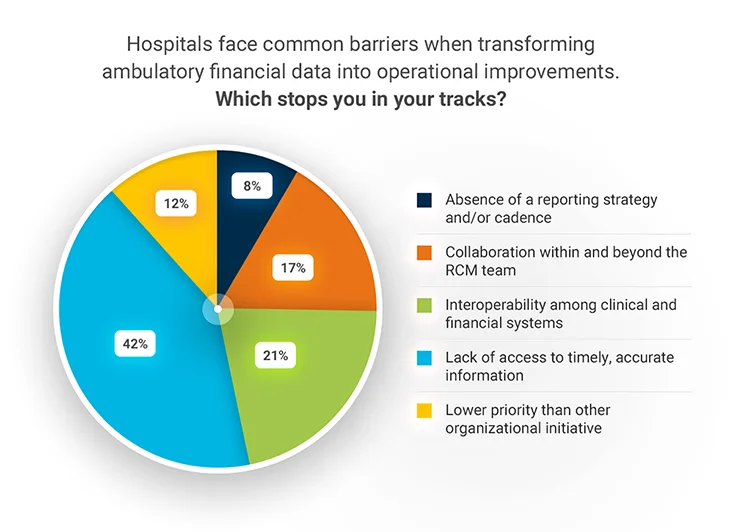

We covered key barriers, strategies for structuring data into actionable insights, and the importance of patient engagement in outpatient financial success. The following article is a detailed recap of our discussion. Before we dove into the content, we asked our webinar audience the following poll question and asked them to select the one common challenge that impacts their organization the most.

The responses highlight the industry’s struggle to integrate and utilize data effectively, underscoring the need for advanced reporting tools and data-driven strategies.

The Journey from Data to Actionable Insights

A central theme of data-driven decision-making is transforming raw RCM operational and financial data into actionable insights. While data alone holds limited inherent value, structuring and contextualizing it enables organizations to drive valuable operational improvements.

The analytics journey progresses from siloed, fundamental data collection through integrating and contextualizing data for broader insights to leveraging AI and “real intelligence” (RI) to drive actionable decisions.

Organizations can move beyond transactional analysis by shifting from static reporting to dynamic, AI-driven insights that support proactively optimizing the RCM process.

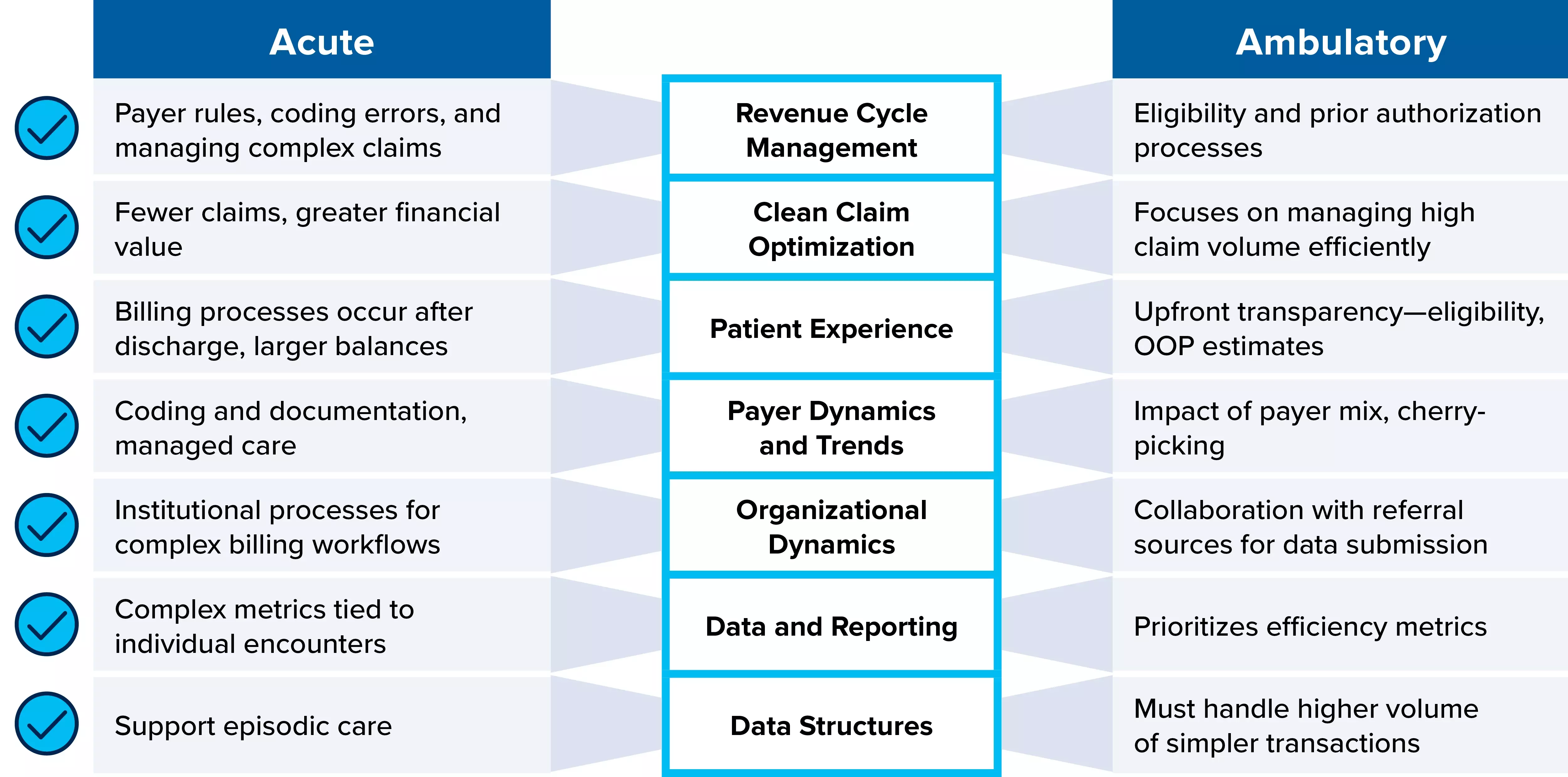

Key Differences in Revenue Cycle Management for Acute vs. Ambulatory Care

Understanding the distinction between acute and ambulatory settings is crucial for optimizing financial workflows. It’s important to note differences in the data needs and challenges between acute and ambulatory care. In the acute care setting, RCM challenges revolve around payor rules, minimizing coding errors, and managing large, complex claims, as there is a higher financial impact per encounter.

In ambulatory care, hospitals experience higher volume, lower clinical complexity, and lower financial impact per encounter. In the ambulatory care setting, eligibility and prior authorization processes are significant pain points, as they directly influence claim denials and the patient experience. Clean claim optimization focuses on managing high claim volume efficiently, ensuring payor-specific policies are met while minimizing denial rates.

While the patient journey can span both settings, ambulatory or outpatient services often serve as the gateway to acute care, thus ensuring seamless revenue cycle processes in ambulatory settings directly impact the overall financial health of the hospital group or health system.

These differences create a need for distinct data structures for each care setting. With operational and financial outcomes in mind, we want to ensure our data is driven with a “referral” lens that may not be as commonly used in the acute space. Data structures have a profound influence on analysis and reporting.

Essential KPIs for Outpatient Financial Optimization

Now that it’s clear why different data is required for RCM in an ambulatory care setting, let’s look at the essential key performance indicators (KPIs) that drive financial success in ambulatory RCM, including:

- Point-of-service (POS) and cash collections

- Charge capture

- Accounts receivable (A/R)

- Clean claims rate

- Net adjusted collections

- Initial denials

- Bad debt

These metrics provide a foundation for identifying gaps, optimizing cash flow, and improving patient and provider satisfaction.

From Data to Information: Advanced Reporting and Outcome-Driven Decision-Making

Advanced reporting techniques help translate data into meaningful actions. The XiFin team recommends a structured approach to reporting, following a few important guidelines:

- Begin with the end in mind – Identify the key decision or action needed, be patient-centric, and have a hypothesis

- Build a data-driven narrative – Establish a baseline, highlight the complication, and present a resolution

- Use “indicator” KPIs – Focus on leading indicators like clean claim submissions and cash acceleration

- Drive conclusions clearly – Ensure stakeholders understand the findings, key takeaways, and next steps

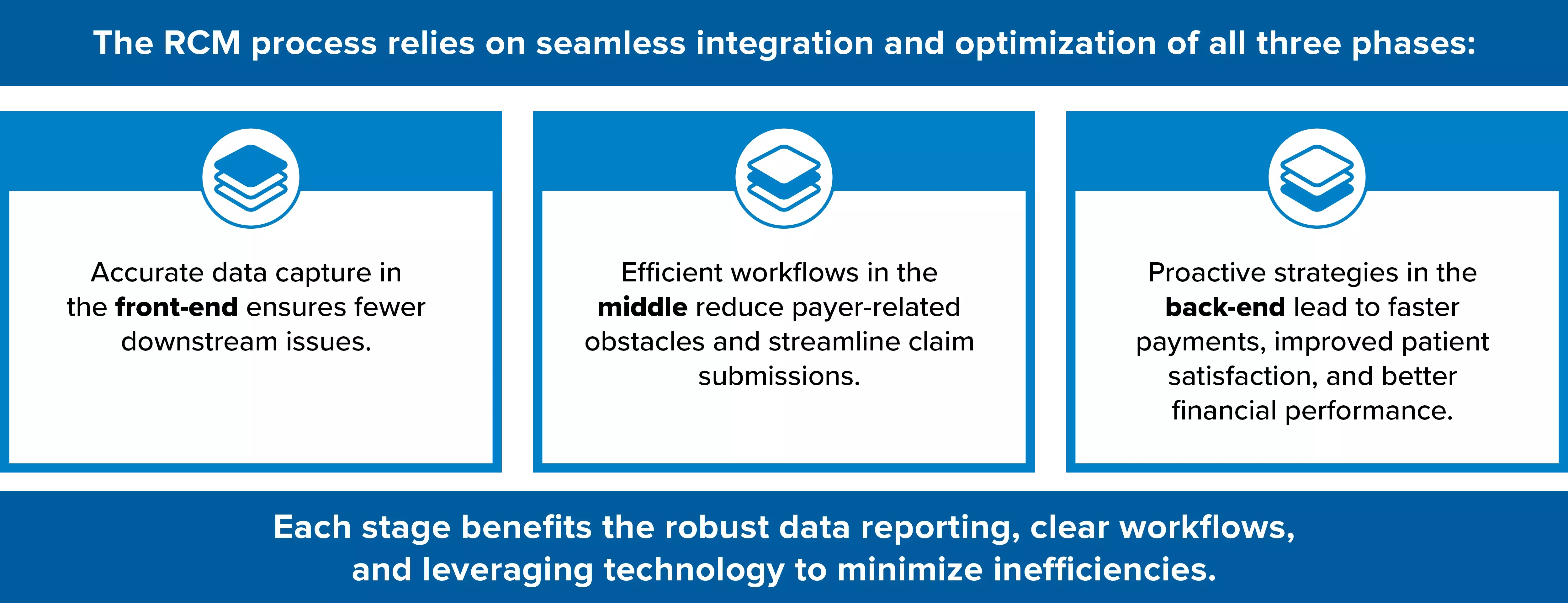

Revenue Cycle Optimization: Front-End, Middle, and Back-End Strategies

Being able to optimize the full revenue cycle is essential, so let’s look at the key elements of each of the three component phases:

Here are just a few of the activities that make up those phases.

| Front-End Optimization | Mid-Cycle Optimization | Back-End Strategies |

|---|---|---|

|

|

|

The Role of Data in Payor and Provider Relationship Management

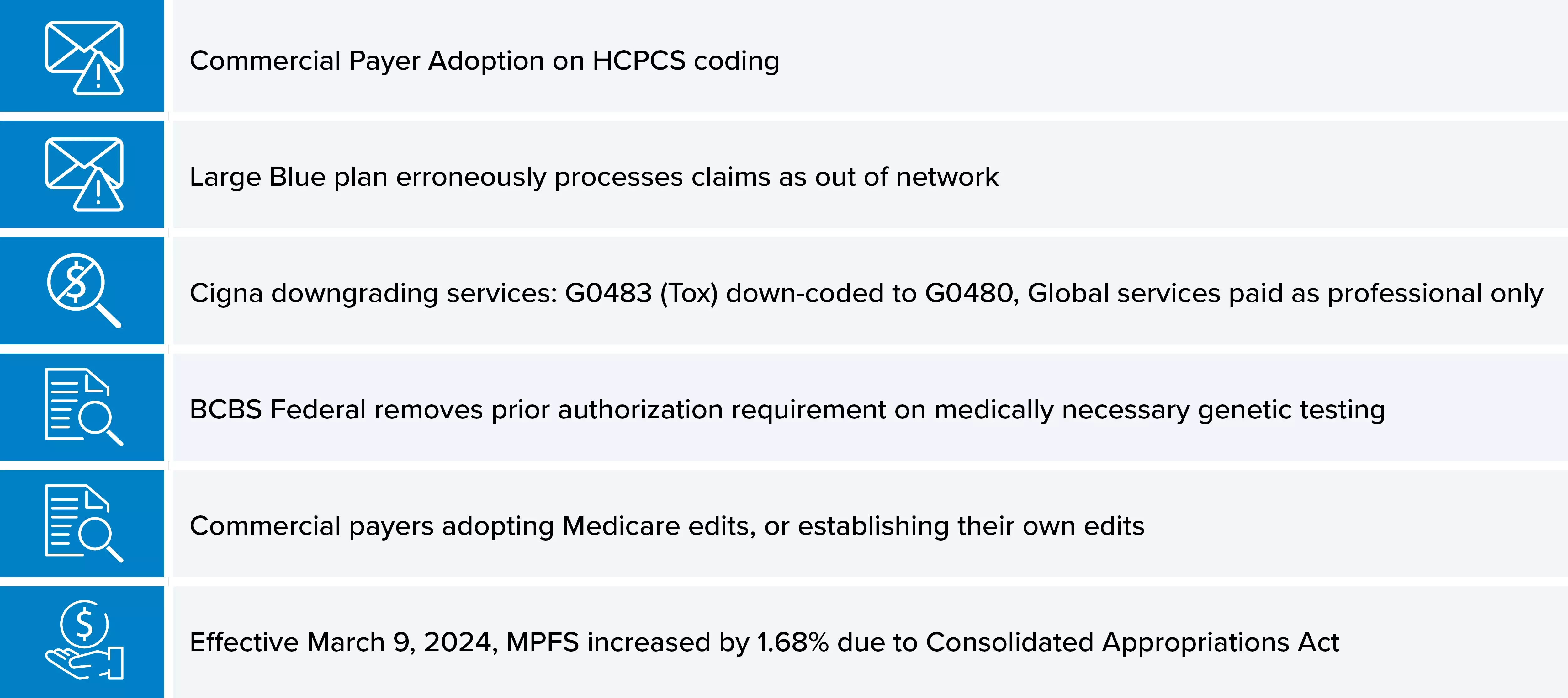

It is also vital to monitor payor behavior and provider referral patterns. Key activities include:

-

Tracking payor reimbursement trends: Identifying shifts in payment policies and addressing unexpected underpayments or denials. Here are a few recent payor trends we’ve seen among our customers.

- Monitoring provider referral data: Ensuring providers submit clean claims to minimize rework and denials

- Assessing provider profitability: Evaluating the revenue and cost impact of different referring providers to optimize partnerships

Enhancing Patient Engagement for Financial Success

In the ambulatory setting, patients have choices, making their experience critical to financial outcomes. Recommendations to enhance patient engagement and the patient experience include:

- Leveraging digital tools: Implementing patient portals for bill payment, insurance updates, and communication

- Strategic Bad Debt Management: Adjusting write-off policies for low-dollar ambulatory claims to improve collections

- Optimizing Dunning Cycles: Using text messaging and automated outreach to accelerate patient payments

Building Your Plan for Ambulatory RCM Success

As you develop your plan for ambulatory financial success, consider:

- Stakeholders – Involve the right people and align to the right metrics

- Systems – Ensure you’re set up for accurate, timely reporting

- Cadence – Report with a frequency that drives informed decision-making without overwhelmin

- Commitment – Cross-department collaboration to drive improvements

As you implement any process improvements or changes, be sure to define, measure, analyze, improve, and control.

Finally, to maximize financial performance in outpatient settings, organizations must:

- Embrace Data-Driven Decision-Making – Leverage AI and analytics to drive operational improvements

- Optimize Revenue Cycle Workflows – Address front-end, middle, and back-end inefficiencies

- Enhance Payor and Provider Strategies – Monitor payor behavior, provider referral patterns, and revenue trends

- Improve Patient Financial Engagement – Implement technology and policies that enhance patient payment experiences

Healthcare organizations can enhance financial performance, streamline operations, and improve patient satisfaction by focusing on these strategies. Watch the full webinar on-demand to learn more about maximizing reimbursement and improving financial outcomes.